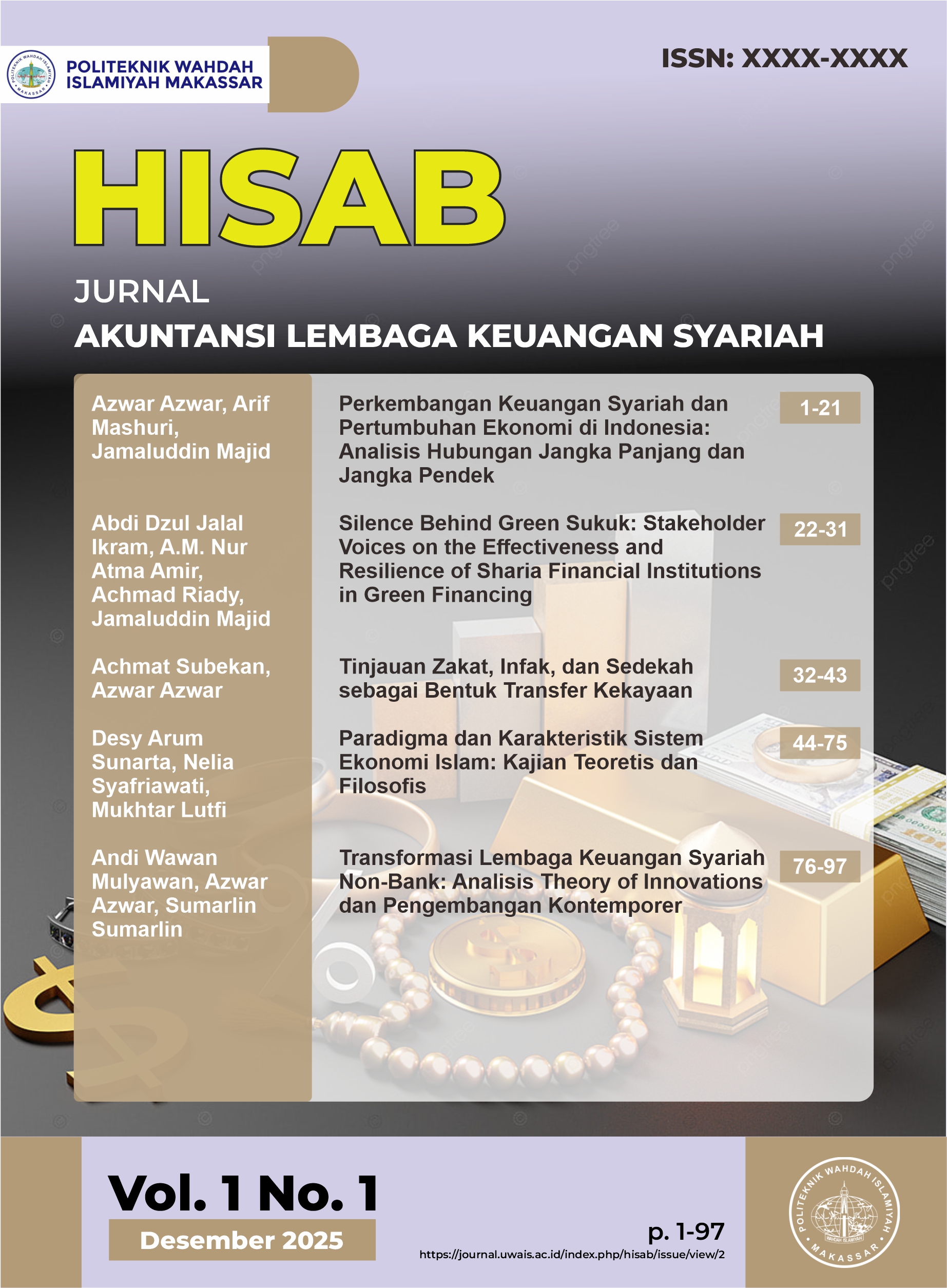

Transformasi Lembaga Keuangan Syariah Non-Bank: Analisis Theory of Innovations dan Pengembangan Kontemporer

Transformation of Non-Bank Sharia Financial Institutions: Analysis of Theory of Innovations and Contemporary Development

Keywords:

Non-Bank Sharia Financial Institutions; Theory of Innovations; Sharia Financial Innovation; Sharia Fintech; Sharia GovernanceAbstract

This study aims to provide a comprehensive understanding of non-bank Islamic financial institutions (NBIFIs) through the perspective of the theory of innovations. Employing a descriptive-analytical method and a library research approach, the study finds that NBIFIs are undergoing fundamental transformations driven by the digitalization of business models, the rise of Islamic fintech, the adoption of AI and blockchain technologies, and the development of innovative financial instruments such as digital sukuk and digital takaful. Innovation is also evident in the strengthening of technology-based shariah governance, including automated shariah compliance and the utilization of RegTech and SupTech. Conversely, NBIFIs face significant challenges related to regulatory gaps, low levels of digital literacy, technological risks, and the need for enhanced human capital capacity. Nevertheless, opportunities such as the growth of the global halal industry, the strengthening of the social finance ecosystem, and regulatory support provide strategic momentum for accelerating innovation. This study projects that the future development of NBIFIs will move toward full digitalization, integration of the halal–fintech ecosystem, tokenization of shariah-compliant assets, and hybrid models that combine commercial and social finance. These findings underscore the importance of maqāṣid al-sharīʿah–oriented innovation as a foundational element for strengthening the long-term competitiveness of NBIFIs.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Andi Wawan Mulyawan, Azwar Azwar, Sumarlin Sumarlin (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.